Introduction of debt:

In the world of personal finance, the concept of debt often sparks debate and confusion. While some debts can be beneficial in the long run, others can lead to financial hardship and stress. In this comprehensive guide, we’ll delve into the intricacies of good debt versus bad debt, exploring their characteristics, implications, and how they can impact your financial well-being.

1. Defining Debt:

Before delving into the nuances of good and bad debt, it’s essential to understand the concept of debt itself. Debt refers to money borrowed by an individual or entity from another party, typically with the expectation of repayment with interest. Whether it’s a mortgage, student loan, credit card balance, or personal loan, debt comes in various forms and can serve different purposes.

Now, let’s differentiate between good and bad debt to gain clarity on their respective roles in personal finance.

2. Good Debt:

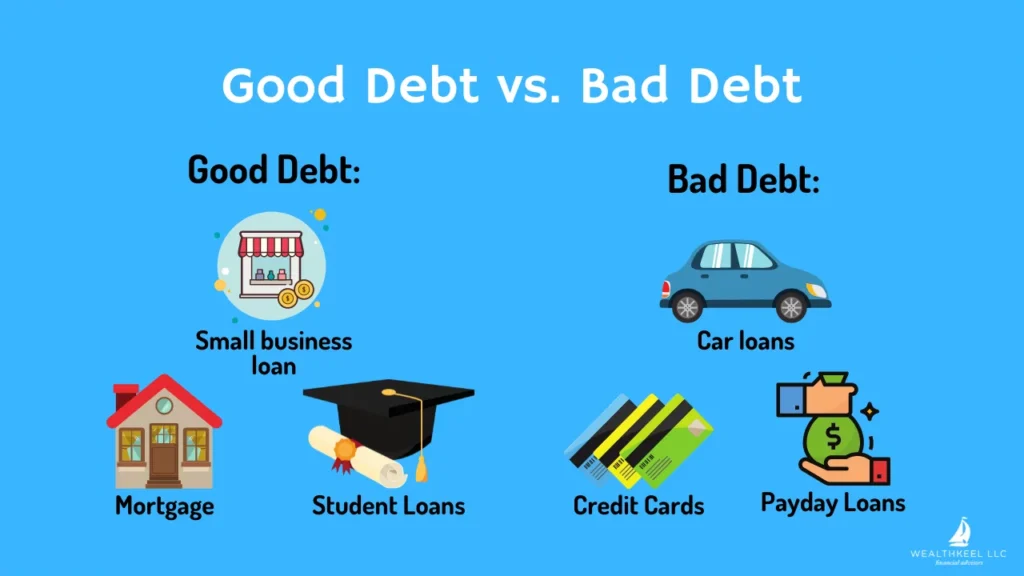

Investing in Your Future: Good debt is characterized by borrowing money for investments that have the potential to increase in value over time or generate future income. For example, taking out a student loan to finance higher education can improve career prospects and earning potential. Similarly, a mortgage for a home purchase can be considered good debt as it allows you to build equity and potentially benefit from property appreciation.

Examples of Good Debt:

Student Loans: Investing in education can lead to increased earning potential and career opportunities, making student loans a form of good debt for many individuals. Mortgages: Owning a home can provide stability and long-term financial benefits, making a mortgage a favorable form of debt for homeowners.

Considerations for Managing Good Debt:

- Interest Rates: Compare interest rates and terms to ensure you’re getting the best deal possible on your borrowed funds.

- Repayment Strategies: Develop a repayment plan that fits your budget and financial goals, considering factors such as loan consolidation or refinancing options.

On the other hand, bad debt can have bad effects on your financial health if not managed wisely.

3. Bad Debt:

A Roadblock to Financial Freedom:

Bad debt typically involves borrowing money for purchases that do not appreciate or generate income. Credit card debt, often accrued through frivolous spending or living beyond one’s means, is a common example of bad debt. High interest rates and revolving balances can quickly spiral out of control, leading to a cycle of debt and financial strain.

Examples of Bad Debt:

- Credit Card Debt: High interest rates and minimum payments can make credit card debt a significant financial burden, especially when used for non-essential purchases.

- Payday Loans: These short-term, high-interest loans often target individuals in need of quick cash but can lead to a cycle of debt due to exorbitant fees and interest rates.

To mitigate the impact of bad debt, it’s essential to prioritize debt repayment and adopt responsible financial habits.

4. Strategies for Managing Bad Debt:

- Debt Snowball Method: Focus on paying off smaller debts first while making minimum payments on larger debts to build momentum and motivation.

- Budgeting and Financial Planning: Track your expenses, identify areas where you can cut costs, and allocate extra funds towards debt repayment.

Ultimately, achieving financial stability requires a balanced approach to managing both good and bad debt.

5. Striking a Balance:

While good debt can be a valuable tool for building wealth and achieving financial goals, it’s essential to borrow responsibly and avoid excessive debt. Similarly, minimizing bad debt through prudent financial habits and disciplined repayment strategies can help alleviate financial stress and pave the way toward long-term financial security.

Conclusion:

In the complex landscape of personal finance, distinguishing between good debt and bad debt is crucial for making informed decisions and achieving financial stability. By understanding the characteristics and implications of each, individuals can leverage good debt to invest in their future while minimizing the impact of bad debt on their financial well-being. Through prudent financial management and responsible borrowing practices, anyone can navigate the complexities of debt and work towards a brighter financial future.